CPhI Middle East & Africa (CPhI MEA) expert Madhukar Tanna, Chief Executive Officer of Pharmax, a United Arab Emirates (UAE) based branded generic manufacturer, says favourable conditions in the UAE are resulting in a boom of pharmaceutical manufacturing throughout the region. Government incentive schemes to increase domestic production, coupled with a brand friendly environment and rising healthcare needs is fuelling surging demand – with many new companies and plants launching in the last two years alone.

Currently, the UAE imports 90 per cent of medicines, with generics accounting for up to 60 per cent of these imports. However, it has been well-publicised that the UAE has identified pharmaceutical manufacturing as a key growth area, with the number of domestic pharmaceutical companies expected to increase significantly.

Commenting on the MEA market, Tanna said “The picture in the UAE is particularly favourable, as we don’t have a true generics sector – rather just branded generics. Drugs produced by manufacturers for sale in the UAE, whether generic or innovator, are licensed to a specific brand. This ensures the highest quality – for which UAE consumers and insurance companies are willing to pay.. The other aspect is that consumers are also willing to pay a premium for drugs made by trusted brands, meaning that in the last few years we have seen a sudden growth of manufacturers. In addition, beyond the UAE there is of course the option of selling into other parts of the MENA region, providing other high-growth markets.”

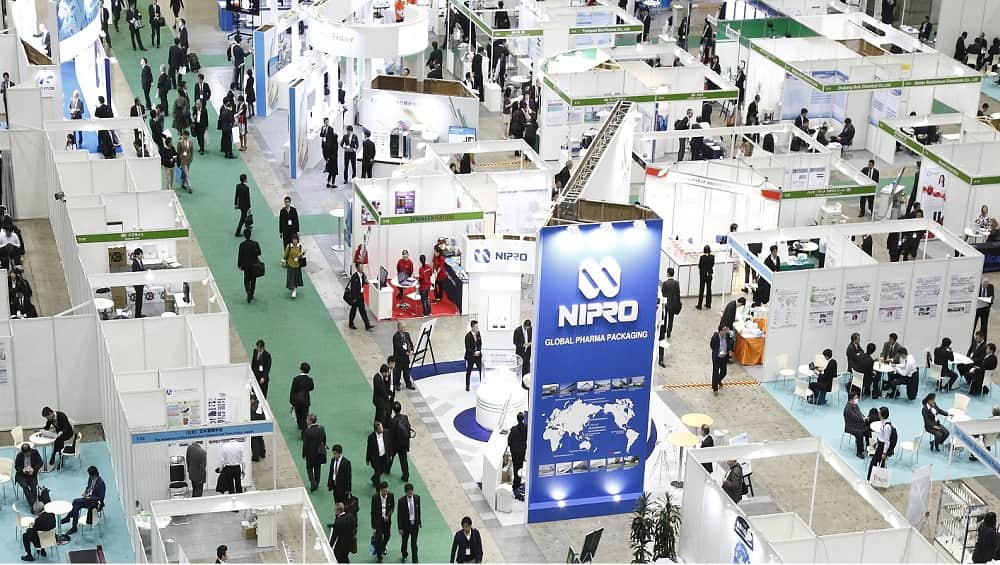

Experts believe ahead of the second CPhI MEA – where nearly 4,900 professionals and 294+ exhibiting companies will be in attendance – the opportunities in the region are rapidly opening-up and many international firms are now looking to partner with local manufacturers to bring products to market. As an example of the increased internationalisation across the region, representatives from more than 100 countries are expected in only the event’s second edition. This year’s event will include finished dose drug companies, ingredients suppliers as well as contract manufacturers and machinery specialists – who are responding to the growth potential of the region.

Interestingly, many manufacturers in the region are operating a new type of regional partnering model. For example, the drive towards locally produced final products in the UAE is supported by development work and process chemistry conducted outside the UAE , and bioequivalence studies from countries such as Jordan. Then once the product has completed development and is ready for commercial sale, manufacturing is transferred to a local manufacturing site in Dubai.

However, in just two years’ time, Tanna believes as the industry matures ‘much of the development work will start to be conducted directly in the UAE’, and this will form a ‘natural evolution’, with regional generic supply also expanding. In the longer term, ‘5-years hence, we will likely see some of the industry also acting as contract manufacturers for supply into Europe’.

“I am totally convinced and confident that the formulation development work will be done in the UAE within two years – guaranteed,” added Tanna.

The conditions have come together synergistically in the last few years, with investors helping build improved plants and launch entirely new companies. It is anticipated that as many as 20 more facilities could be added in the next few years, with the UAE emerging as a new final product manufacturing hub.

“At CPhI MEA we have seen a notable increase in new finished product manufacturers across the region looking to work with international partners for development and API, as well as sourcing regional distributors. The conditions are really favourable, and we continue to see an expanding base of manufacturing, particularly in the UAE, Jordan and Saudi Arabia.” added Cara Turner, Brand Director at Informa.

The region, however, does face a number of potential head winds, including a need for further integration across the GCC (Gulf Cooperation Council) – which despite recent efforts over the last 5-years – still fall short of true mutual recognition among all parties according to Tanna. He believes that we could be set for ‘a period of extended compounded growth if the region’s Governments can align more quickly’.

The pharma market in MENA was worth $31.8 billion in 2018 and is forecast to grow with a compound annual growth rate of 6.9% reaching $41.5 billion by 2022. Saudi Arabia remains the biggest overall market.

Another area highlighted for potential future growth are in inhalers and biosimilars – in particular we should expect companies to begin investing in sterile capabilities across the region – where there is a particularly noticeable gap in the domestic manufacturing production capabilities.

CPhI MEA will take place at the ADNEC Centre, Abu Dhabi, United Arab Emirates (UAE), from 16-18 September 2019, attracting leaders and key decision makers to the heart of this new pharma hub. The event will co-locate ICSE, P-MEC, Innopack and FDF, providing the opportunity to meet with regional drug manufacturers, suppliers of pharma ingredients, distributors, finished dose manufacturers, and companies involved in pharma machinery, packaging and contract services.

About CPhI

CPhI drives growth and innovation at every step of the global pharmaceutical supply chain from drug discovery to finished dosage. Through exhibitions, conferences and online communities, CPhI brings together more than 100,000 pharmaceutical professionals each year to network, identify business opportunities and expand the global market. CPhI hosts events in Europe, Korea, China, India, Japan, South East Asia, North America, and the Middle East and Africa. Co-locating with ICSE for contract services; P-MEC for machinery, equipment & technology; InnoPack for pharmaceutical packaging; BioPh for biopharma; and Finished Dosage Formulation for every aspect of the finished dosage supply chain. For more information visit https://www.cphi.com

About UBM (and parent company Informa)

CPhI is organised by UBM, which in June 2018 combined with Informa PLC to become a leading B2B information services group and the largest B2B Events organiser in the world. To learn more and for the latest news and information, visit www.ubm.com and www.informa.com