The biologics contract development market in Asia-Pacific is evolving into one of the hottest segments in the world of pharmaceuticals. Bringing together the themes of technological innovation, cost efficiency and geographic reach, this market is increasingly at the heart of the strategies of both multinational biopharma giants and newer players. Given the substantial and increasing share of the global biologics market attributed to the Asia-Pacific region, a focus on contract development services is opening the door to a new set of efficiencies and breakthroughs in biopharmaceutical production.

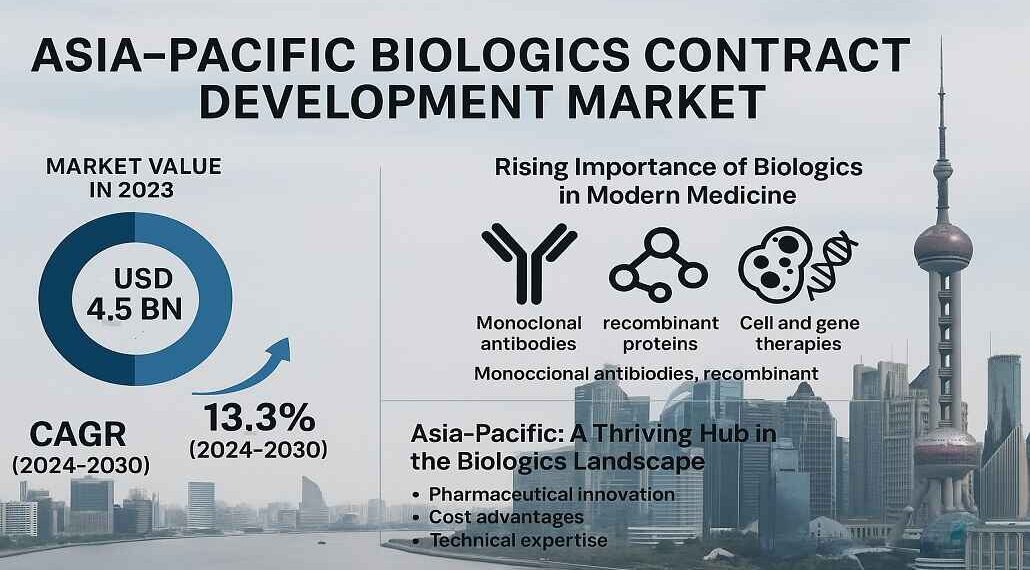

The Asia-Pacific biologics contract development market was valued at ~USD 4.5 billion in 2023 and is expected to expand at an impressive compound annual growth rate (CAGR) of 13.3% during the forecast period (2024-2030). With expertise in biopharmaceutical development in the region, efficient manufacturing at competitive costs, increased demand for biologics and improved regulatory frameworks to support the industry, this compelling growth continues.

Rising Importance of Biologics in Modern Medicine

Biologics–monoclonal antibodies, recombinant proteins, cell and gene therapies–are a cornerstone of modern medical innovation. Their sophisticated molecular designs and precise action mechanisms have facilitated groundbreaking therapies for various ailments, such as cancer, autoimmune diseases, and rare genetic disorders. But the construction and production of biologics brings with it separate challenges, including sophisticated infrastructure, stringent quality controls, and extremely specialized expertise.

To combat these challenges, many biopharma companies are seeking out contract development and manufacturing organizations (CDMOs). Through outsourcing biologics development and production to experienced partners, companies can utilize their expertise to concentrate on their core competencies, streamline the time-to-market, and mitigate operational risks. In this environment, Asia-Pacific has become a favored location for biologics CDMO services, combining cost advantages, technical expertise and increasing capacity.

Asia-Pacific: A Thriving Hub in the Biologics Landscape

It is not by chance that the Asia-Pacific region is experiencing rapid growth in the biologics contract development market. The mix of economic policies, investment in biopharma infrastructure and a rapidly expanding talent pool of professionals has helped propel the region’s prominence. Today, pharmaceutical innovation is synonymous with China, India, South Korea, Singapore, and to a lesser degree with some of the economies in the next tier, and some observers would argue that much of this development has been in biologics.

China, in particular, is a major player, motivated by its government’s Healthy China 2030 initiative, which emphasizes biopharma research and development. With more than 400 biologics manufacturing sites and leading monoclonal antibody technologies, the nation is combining cutting-edge technology with low-cost manufacturing. Domestic firms such as WuXi Biologics have set benchmarks in contract manufacturing, servicing international clients and conducting high-volume production runs that meet international regulatory standards, including those of the U.S. FDA and European Medicines Agency (EMA).

India, for its part, has emerged as a major player in the production of cost-effective biologics. Indian CDMOs are making inroads into the global marketplace, capitalizing on cost competitiveness, regulatory compliance infrastructure, and a wealth of experience in the area of biosimilars. As India develops a robust pipeline of biosimilars and expands its capabilities to export biologics products, it is establishing itself as a competitive biologics development services hub.

A major contributor to the Asia-Pacific biologics ecosystem are Singapore and South Korea. Singapore for its part offers an extraordinarily business-friendly framework, strong IP protections and world-leading infrastructure, while South Korea is prioritising innovation-driven growth with a particular emphasis on cell and gene therapy manufacturing. Firms such as Samsung Biologics are driving mega-manufacturing initiatives in the biologics space, which in turn ensures South Korea retains its crown as the contract development powerhouse.

Key Growth Drivers

The Asia-Pacific biologics contract development market is multifaceted, with its growth being fueled by a number of interlinked factors. T First and foremost, the rapid rise in biologics demand globally and particularly within the region has placed pressure on pharmaceutical companies to expand their production capacities. According to industry reports, biologics account for over 40% of new drug approvals annually and are expected to constitute nearly half of global pharmaceutical sales by 2028. This surge necessitates not only increased capacity but also the ability to develop biologics cost-effectively and efficiently, which is where CDMOs step in.

Moreover, the Asia-pacific region provides unique cost advantages since the cost of CDMO services is generally 30–40% cheaper than those from North America or Europe. This cost efficiency also included the sourcing of raw materials, operational overhead and construction of facilities, all things that make the region even convenient for global pharma firms.

Further amplifying the region’s appeal are initiatives to streamline regulations and encourage international collaborations. The adoption of International Council for Harmonisation (ICH) guidelines and the strengthening of regulatory frameworks have instilled greater confidence in the quality and safety of biologics manufactured in Asia-Pacific. Governments are also investing heavily in biopharma parks and innovation hubs to support new entrants and foster collaboration between academia and industry.

Another key driver is the increasing incidence of chronic diseases and aging populations in Asia-Pacific. As incidences of diseases like cancer, diabetes, and autoimmune conditions increase, the domestic demand for biologics continues to grow, carving a win-win environment of supply and demand for local CDMOs.

The Role of Emerging Technologies

In addition, the implementation of innovative technologies including but not limited to artificial intelligence (AI), machine learning, and bioprocessing technologies, are contributing to the market development in the Asia-Pacific biologics contract development (biologics) market. Platforms powered by artificial intelligence are being used to enhance cell line development, refine yield predictions, and automate regulatory submissions. There is the introduction of automation and next generation sequencing into biomanufacturing processes for precision and scalability as well.

Global geopolitical tensions and concerns around IP protections in certain markets may also influence the pace at which international clients partner with Asia-Pacific CDMOs. Nevertheless, the opportunities far outweigh the challenges. The region’s strategic focus on innovation, emphasis on world-class infrastructure, and commitment to achieving global standards position it as a key player in the next phase of biologics market growth.

The Role of Emerging Technologies

The Asia-Pacific biologics contract development market has significant growth potential, but its growth trajectory is not yet seamless. Biologics manufacturing is complex, necessitating high capital investment, expert talent, and strict compliance with regulations. Although significant progress has been achieved by most countries in the region, there is still the need for better coordination between stakeholders to address bottlenecks in the supply chain and to harmonize operational practices.

Geopolitical tensions around the world and the potential apprehension surrounding IP protections in specific markets will play role in the velocity at which international clients partner with Asia-Pacific CDMOs. Still, the chances far outnumber the challenges. Through its targeted innovation, world-class infrastructure, and global standards, the region is also being positioned to play a role in the next stage of biologics market growth.

The Road Ahead

Looking ahead, the Asia-Pacific biologics contract development market is expected to continue its upward trajectory, driven by increasing demand for biologics, advancements in bioprocessing technologies, and expanding regulatory harmonization. Industry analysts project that by 2030, the market will surpass USD 10 billion, making it one of the fastest-growing segments in the global biopharma ecosystem.

As the focus on biologics increases across the health spectrum, including in emerging areas like oncology, rare diseases, and gene therapies, the region’s ability to deliver on cost and innovation will be key to supporting continued growth. Through collaboration, infrastructure investment, and emerging technologies, the Asia-Pacific biologics contract development market will undoubtedly be a transformative force in shaping the future of global healthcare.

In conclusion, the growth of the Asia-Pacific biologics contract development market is a testament to the region’s resilience and adaptability in meeting the ever-evolving demands of the pharmaceutical industry. With its combination of cost advantages, technical expertise, and a commitment to innovation, the region is well-positioned to become a global leader in biologics manufacturing and development. The future of biopharma, it seems, is increasingly being written in the laboratories and manufacturing facilities of Asia-Pacific.