Report DescriptionTable of ContentSummaryRequest Sample

The U.S. IVD market is projected to reach USD 25.99 Billion by 2020 at a CAGR of 4.7% during the forecast period of 2015 to 2020. Some of the key factors driving the growth of this market are the rising incidence of chronic and infectious diseases in the U.S., rapidly aging population, growing preference for point-of-care testing and personalized medicine, implementation of the Affordable Care Act (ACA), increasing adoption of automated instruments, and automation in laboratories. The extending reach of molecular diagnostics and new range of condition-specific markers and tests with advances in genomics and proteomics are creating new opportunities for this market. However, the unfavorable reimbursement and lack of sufficient budget is hampering the growth of the U.S. IVD industry. Stringent regulatory framework presents a significant challenge to the market growth.

Over the past few years, the U.S. in vitro diagnostics market has witnessed steady growth owing to the increasing demand for high-performance products. Increasing urbanization and changing lifestyles have resulted in the growing incidence of chronic ailments such as diabetes, blood pressure, and cardiovascular diseases. This is further fueling the demand of innovative in-vitro diagnostic products for the early detection and diagnosis of these diseases. As a result, currently, most of the leading players in the in vitro diagnostics market are focusing on acquisitions as a major strategy to capture market share and sustain their leadership position in this market. Acquisition of similar or smaller players has enabled these companies to achieve greater competitiveness through the expansion of their product portfolio and technological expertise in a short period of time.

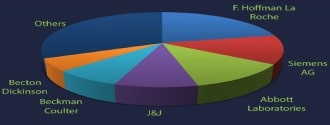

Geographically, the U.S. is the largest regional segment of the global IVD market. The large share of this region can be attributed to the accessibility to technologies, superlative opportunities for molecular diagnostics in genetic testing and cancer screening, established distribution channels, and the presence of a large number of market players such as Abbott Laboratories, Inc., Johnson & Johnson, Becton, Dickson and Company, Danaher Corporation, Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Inc., and Alere, Inc. Roche Diagnostics Limited (Switzerland), Danaher Corporation (U.S.), Siemens Healthcare (Germany), Thermo Fisher Scientific Inc. (U.S.), and Abbott Laboratories, Inc. (U.S.) are the leading companies, which accounted for ~50-55% of the market in 2014. However, new local players are intensifying competition and thereby threatening the market share of existing players. In order to maintain their shares, leading players are continuously adopting various strategies. This increased competitiveness is expected to drive innovation in the market, thereby driving market growth.

To know about the assumptions considered for the study, download the pdf brochure

Stakeholders of the Report:

- IVD Product Manufacturers

- Group Purchase Organizations (GPOs)

- OEM Manufacturers

- Clinical Laboratories

- Distributors of IVD Products

- Hospitals and Clinics

- Healthcare Institutions

- Research Institutes

- Market Research and Consulting Firms

- Venture Capitalists and Investors

- Scope of the Report

This research report categorizes the U.S. IVD market on the basis of products & services, technologies, applications, and end users. These markets are further segmented, providing value analysis for 2013, 2014, and 2015, as well as forecast up to 2020. The end user market is comprehensively analyzed by region (South, Midwest, West, and Northeast) to provide in-depth information on the U.S. scenario.

U.S. In Vitro Diagnostics Market

This research report categorizes the U.S. in-vitro diagnostics market into the following segments:

U.S. In Vitro Diagnostics Market, by Products & Services

- Reagents

- Instrument

- Fully Automated Instruments

- Semi-automated Instruments

- Others

Data Management Systems/Software

Services

U.S. In Vitro Diagnostics Market, by Technology

- Clinical Chemistry

- Immunochemistry/Immunoassay

- Hematology

- Coagulation & Hemostasis

- Microbiology

- Molecular Diagnostics (MDx)

- Other Instruments

U.S. In Vitro Diagnostics Market, by Application

- Infectious Diseases

- Diabetes

- Oncology/Cancer

- Cardiology

- Endocrine Disorders

- Autoimmune Diseases

- Bone & Mineral Disorders

- Pulmonary Disorders

- Others

U.S. In Vitro Diagnostics Market, by End User

- Hospital Laboratories

- Clinical/Independent Laboratories

- Large Laboratories

- Medium-sized Laboratories

- Small Laboratories

- Others

U.S. In Vitro Diagnostics End User Market, by Region

- Hospital Laboratories Market

- South

- Midwest

- West

- Northeast

Clinical/Independent Laboratories

- South

- Midwest

- West

- Northeast

- Others