Ahead of CPhI Discover (17th-28th May, 2021) – global pharma’s largest ever virtual gathering – the CPhI executive post-pandemic pharma survey predicts that pandemic supply chain issues have further cemented a push for repatriated manufacturing globally. The findings suggest that over the next five years, governments and companies will gradually look to reduce complexity and increase regional self-reliance.

Highlighting this issue’s current prominence, the implications of this shift are to be fully explored by a panel of experts during a live session (Thursday 20th May at CPhI Discover). In particular, the merits of offshore vs onshore manufacturing, and/or if reshoring represents a rethinking of innovation approaches – with new manufacturing technologies introduced to improve efficiency. The recent launch[ii] of a new type of CDMO with ‘powerful new technologies’ to meet post-pandemic vaccination needs is potentially an early indicator of the changing landscape.

Overall, some 500+ executives in the survey were extremely bullish in their outlook for pharma manufacturing both in the medium and longer term. In fact, more than 60% of executives anticipate COVID-19 will ‘greatly improve the business outlook in 2021 and beyond’ – driven by expanding global demand for the existing COVID treatments and upscaling. Consequently, the contract services industry is predicted to grow even faster to meet demand. During CPhI Discover’s opening day, analysts Eric Langer (President at Bioplan Associates), Peter Shapiro (Editor at PharmSource, a GlobalData Company) and Samsung Biologics will explore how the contract industry can capitalise on this new demand – both globally and regionally in ‘Navigating the CDMO Market: Hurdles, Transformation & Opportunities’ (Tuesday 18th May).

Another issue the pandemic magnified was the global reliance on sourcing starting materials from suppliers in Asia, where 80% of materials are sourced from. However, the market is broadly ambivalent, with almost half of the respondents now stating it is realistic to ‘localise the manufacture of starting materials’, verses more than a third that suggest that any potential mass move would be ‘too disruptive to a complex industry’, while a further 15% believe it would be ‘desirable’.

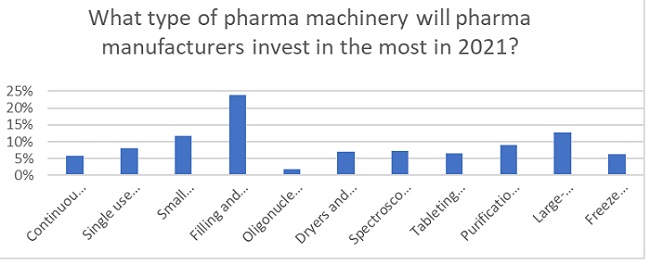

The industry is also seeing an expansion and modernisation of finished dose manufacturing, with ‘filling and packaging systems’ (24%) voted as the machinery type that pharma manufacturers will invest in the most in 2021. This is driven by drug product CMOs/CDMOs investing to become one-stop shops so they can aid innovators in simplifying and streamlining outsourcing, as well as the huge logistical challenge of filling billions of COVID-19 vaccines. Manufacturers are also expected to expand their capabilities and capacity for biologicals and capitalise on the impending wave of biologics approvals over the next few years, with large-scale bioreactors and fermenters (13%) expected to be popular in the upcoming year.

Figure: Shows what type of pharma machinery pharma manufacturers will invest in the most in 2021

To examine the opportunities in greater detail, the second day of CPhI Discover will explore packaging & drug delivery covering a wide range of issues from ‘cold chain storage challenges’ and ‘track and trace solutions’ to ‘glass packaging solutions’ and ‘autoinjectors’. It will be headlined by a live panel discussion entitled: ‘Drug Delivery Start-Ups to Watch in 2021 and Beyond’ (Wednesday 19th May), offering foresight into what the future of drug delivery might hold in terms of regulation, capital raising, and investments.

“Our industry survey shows that pharma, ingredients providers, manufacturers and the contract services pipeline have fared well through the last year, but structural changes in the industry and an expansion in the pipeline means demand is growing quickly. In response, we have designed a detailed agenda to explore the biggest opportunities at CPhI Discover. Then armed with these new insights, attendees can utilise the second week of the event to meet new partners and consider the best approach to expedite growth and development. It is a crucial moment for the industry and getting a head start now on partnering will deliver the best returns, especially as resources in an expanded industry become more competitive. We designed the event so that meeting and sourcing is as easy as possible and accelerates growth,” commented Nicola Souden, Brand Manager at Informa.